A Case for Free Trade in Labor

Benjamin Powell, Ph.D.

Texas Tech University

Volume 1, Issue 2

Click the Button Below to Download a PDF Version of this Issue Brief

Executive Summary

Immigration is one of the more controversial policy areas of our time, and economics research offers a lot to better understanding the effects of immigration. Economists generally agree that free trade in capital and goods tends to promote the welfare of all trading partners. Yet massive restrictions currently exist on the movement of labor across borders, and many countries are proposing even further restrictions. Numerous economic studies demonstrate that moving in the opposite direction—toward a free market in labor—would yield massive gains in productivity and overall human well-being. Even though this is the case, many native-born people in destination countries fear that their welfare would go down with more immigration. Leading economics research, however, shows that immigration to the United States boosts the overall size of the U.S. economy, leads to new job creation, and does not reduce domestic wages other than for workers without a high school degree. While economics research is so far inconclusive on whether immigrants contribute more in taxes than they receive in government spending, either direction the estimated effect is small. New research in economics is tackling the question of immigrants changing the culture in destination countries. Overall, in light of economics research on immigration, the basic case for free trade in labor is similar to the case for free trade in goods: huge overall gains with relatively small pockets of losses. Current debates over immigration could benefit by incorporating these insights from the economics of immigration.

A Case for Free Trade in Labor

Benjamin Powell

Few public policy issues in the United States today generate as much controversy and polarization as immigration. Recent political proposals include policies ranging from building a border wall to exclude illegal immigrants, to cutting legal immigration in half, to legalizing illegal immigrants who were brought to the United States as children. Unfortunately, all too often the public discourse on immigration occurs with little understanding of the research economists have done to understand how immigration impacts the United States.

Economists have understood for more than two hundred years that free trade between nations is mutually beneficial. Adam Smith articulated the basic case for free trade based on specialization and the division of labor in his famous treatise The Wealth of Nations in 1776. [1] David Ricardo refined the case for free trade by showing that trade flows are dictated by what economists call comparative advantage: each person and country specializes in producing what they can produce at lowest relative cost, and then trades with others for the goods the others produce more efficiently.

Today, few ideas command as much agreement among economists as the notion that free trade generally promotes the welfare of all trading partners. Trade policy has generally moved in the direction recommended by economists since the end of World War II. Tariffs, quotas, and other barriers to free trade have been repeatedly reduced in multilateral negotiations. The Trump era has seen some retreat of trade policy away from these principles, but the overall effect of this shift is still unfolding.

Despite such widespread agreement, one category of trade continues to feature massive trade barriers: labor. While the world has moved toward freer trade in goods, services, and capital flows, massive quantitative restrictions remain on laborers who wish to move to another country. Free trade in goods, services, capital, and labor can substitute for each other to some extent. When labor is unfree to move, capital can flow to where the labor is and goods can be assembled and shipped elsewhere. But free trade in goods and capital does not completely substitute for labor mobility.

Some services must be provided on site. If laborers in Mexico have a comparative advantage in construction or landscaping in the United States, then they need to be able to move to where the service is needed. Similarly, if a nanny in India is the lowest-cost provider of child care in the United States, she can’t provide the service from India. She must move to where the service is needed.

Geography and climate often dictate where food is best grown. If the laborers best suited to agricultural work are not free to move to these locations, then food will be inefficiently produced with the wrong laborers, with too much capital, and in the wrong places. Migration restrictions in the United States today keep out Latin American workers who would more efficiently harvest crops than the high-cost labor and capital employed because of the agricultural labor shortage.

Furthermore, as economist Julian Simon long argued, human beings are the ultimate resource.[2] It is human creativity that turns nature into natural resources and raw materials into valuable capital and new technologies. Unfortunately, much of humanity, by accident of birth, lives in countries with lousy governance that doesn’t allow people to make the most of their creativity and potential. Countries with governments that fail to protect private property rights, that grant few economic freedoms, and that don’t maintain a tolerable degree of the rule of law, all fail to make the most of the human creativity within their borders and, as a result, have stagnant economies mired in poverty.

When humans living under lousy governments are allowed to move to countries with relatively better governance and a larger stock of physical capital, plus other humans who have accumulated high skills and education, the immigrants to these countries are instantly better able to make use of their own skills and creativity. When Haitians or Nigerians move to the United States, their earnings go up an average of 1,000 percent without anything other than their location changing. For Mexicans moving to the United States, earnings go up around 150 percent. Economists call this the “place premium.”[3]

Virtually every developed country in the world places extreme quantitative restrictions on immigrants, and most also regulate and limit the ability of nonmigrant foreigners to provide temporary work while there. As a result of these severe restrictions on the international movement of laborers, the potential gains from liberalization are massive.

Numerous economic studies have estimated the global gains that could be achieved if rich countries removed their migration restrictions and allowed for free trade in labor. The estimated global gains range from 50 percent to 150 percent of global GDP[4]—on average, a permanent doubling of global GDP. Unrestricted migration would essentially eliminate extreme poverty while massively expanding global output.

Although the estimated magnitude of the increase in global output may surprise some people, most people realize immigrants gain massively by moving—after all, that’s why they move—and as a result total output would increase. However, many people fear that while immigrants gain, the native born in destination countries must lose.

Many of these fears are the exact same baseless fears people have about international trade in goods and services. The three most common fears are that (1) while the immigrants will get richer, we will get poorer; (2) immigrants will steal our jobs; and (3) low-cost immigrant labor will depress our wages. Let’s consider each in turn.

Immigrants boost the overall size of the US economy for the existing native-born population. Free trade in labor, like trade in goods and services, frees existing Americans to do what’s in their comparative advantage. How big is the net benefit of immigration to the native-born population? Harvard economist George Borjas is probably the most established academic critic of immigration. Using his classic back-of-the-envelope calculation method and updating it for the current stock of immigrants puts the annual gain to the native-born US population at about $50 billion per year from immigration.[5]

As a proportion of our $17 trillion economy, $50 billion is rather small. But it’s still a gain, not a loss. Furthermore, other methods of calculating the net benefits of immigration lead to larger numbers, though all remain modest as a percentage of our economy. Also, the current gain natives derive from immigration is directly related to the government’s restrictive immigration policies. If greater numbers were let in, if the government didn’t severely limit the number of skilled-worker H1-B visas, and if illegal immigrants had better access to formal-sector employment, the net gains could be larger.

Perhaps the most popular economic misconception about immigration is that immigrants “steal our jobs.” It’s a classic example of what the nineteenth-century French economist Frédéric Bastiat labeled, in the context of international trade, “what is seen and what is not seen.” Everyone can see when an immigrant takes a job that used to be held by a native-born worker. But not everyone sees the secondary consequences, which include new jobs created because native-born labor has been freed up for more-productive uses. In the market’s process of creative destruction, jobs are created and destroyed all the time. It’s often hard to see which ones are created specifically because of immigration.

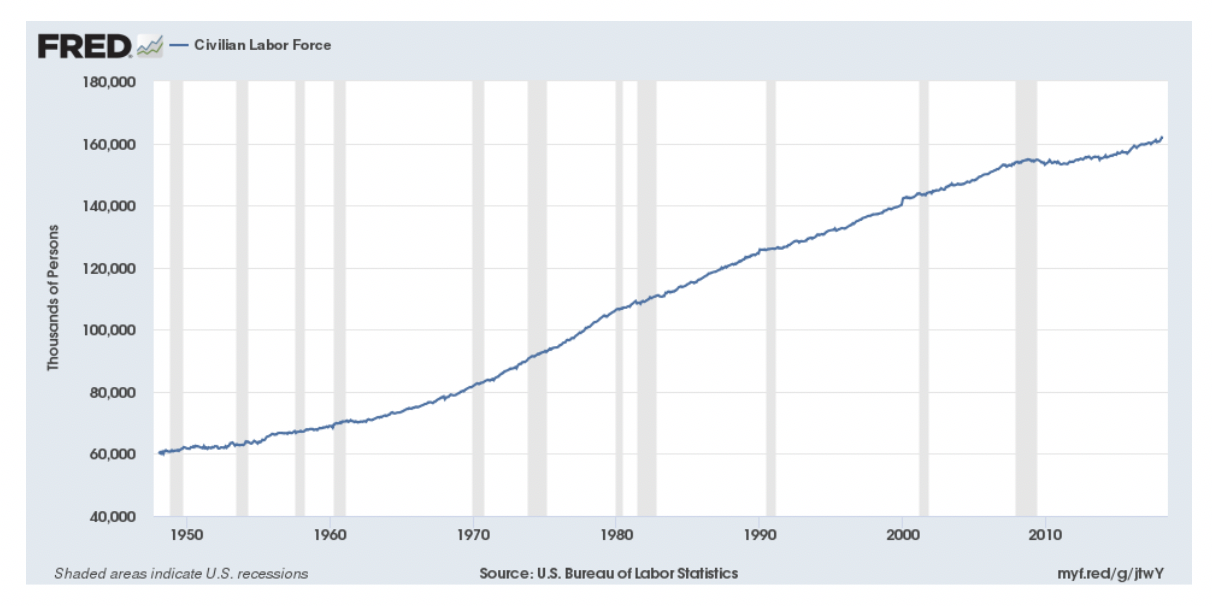

If immigrants really did take jobs from existing native-born workers without new jobs also being created, the same should be true any time we add more workers to the economy. Since 1950, there has been massive entry of women, baby boomers, and immigrants into the workforce. As figure 1 shows, the civilian labor force grew from around 60 million workers in 1950 to more than 160 million workers today. Yet there has been no long-term increase in the unemployment rate. In 1950, the unemployment rate was 5.2 percent, and as of December 2017 it stood at 4.1 percent. As more people enter the labor force, more people get jobs.

Figure 1:

Source: U.S. Bureau of Labor Statistics

Size of U.S. Civilian Labor Force, Post WWII Era

Many people fear that as more immigrants enter the workforce, they must push down the wages of the native-born population. Introductory supply-and-demand analysis tells us as much. An increase in the supply of labor should push down wage rates. However, when economists measure the impact of immigrants on the native-born population, they don’t find any general decrease in wages. In fact, the debate on the effect of immigration on wage rates of native-born workers has narrowed to the effect on wages of high school dropouts. Estimates range from slightly positive to, at worst, an 8 percent fall.[6]

How is this possible? Don’t the laws of supply and demand dictate that wages would fall? Not when other things change at the same time. The same immigrants who increase the supply of labor also demand goods and services, causing the demand for labor to increase. This means the effect of immigration on wages shifts from being a theoretical question to being an empirical one.

Second, immigrants don’t simply shift the supply of labor. Labor is heterogeneous. When the immigrants have different skills than the native-born population, they complement the native-born laborers rather than substitute for them. Many of the immigrants to the United States are either extremely highly skilled or very low skilled. Yet most native-born labor falls somewhere in between. The native-born population makes up around one third of adults in the United States without a high school diploma. A large portion of new PhD degrees are awarded to foreign-born people. To the extent that immigrants are complementing US laborers, they can increase, rather than decrease, the wages of the native born. It’s no accident that economists only find potential evidence of a negative impact on the wages of the native born in markets, such as low-skilled labor done by people without a high school diploma, where the immigrants and natives have more similar skill sets.

When only the impact of the international movement of labor is considered, the economic consequences of free trade in labor are quite similar to those of trade in goods. Both types of trade allow for foreign and domestic citizens to specialize in what they do relatively more efficiently, so both increase the size of the economic pie. Both trade in goods and trade in labor change the mix of employment of the native-born population but not the total number of jobs. And neither results in average wages being depressed, although, at least in the short run, those who most directly compete with the foreign labor may experience decreased wages until they get reemployed in other sectors.

Where free trade in labor differs from trade in goods is that laborers aren’t just laborers. They are people too and often come with families and can have impacts outside of their impact on labor markets. One common fear is that immigrants or their family members might consume more government-financed services such as schooling, medical care, and welfare than they pay in taxes and thus might generate a fiscal drain. There are numerous studies estimating the fiscal impact of immigration. Good studies measure not just the taxes immigrants pay, but also increased taxes others, such as employers of immigrants, pay because of immigration. Good studies also look at the impact over time by estimating future demands on government services and taxes paid.

Some studies that do both of these things find existing immigration creates fiscal gains. Other studies find fiscal drains. But most estimates in either direction tend to be small.[7] However, it is at least conceivable that if the United States moved toward allowing free trade in labor, larger drains could occur. However, drains need not persist. The economics of free trade in labor tells us that the overall economic pie would get much bigger without quantitative restrictions on movement. Some of that larger pie could be allocated via changes in fiscal policy to offset any significant fiscal drains that may emerge.

The cutting edge of the debate among immigration economists today revolves around whether laborers, as immigrants, might bring with them, either intentionally or unintentionally, some of the social capital of their origin countries that is responsible for poverty there, which could erode the formal or informal institutions responsible for high productivity in destination countries. If they do, the large increase in the economic pie estimated by economists could vanish once too many immigrants arrive.

Thus far, this fear remains a conjecture without supporting evidence.[8] Economists have begun conducting studies estimating how immigrants impact institutions in destination countries, and it appears, so far, that either immigrants have little effect on institutions related to productivity or they actually enhance, rather than undermine, those institutions.[9] However, this is a new field of study and much remains to be done.

The basic economic case for free trade in labor is essentially the same as the case for free trade in goods. Immigration is more complicated than trade in goods because immigrants are people who have noneconomic impacts. But if economists are correct that freeing trade in international labor markets could double world GDP, it seems likely that some of that increased wealth could be used to fix any complications that arise. Current popular debate surrounding the desirability of various immigration-policy reforms would be greatly improved if policy makers and the general public paid more attention to the research findings of economists who study immigration.

About the Author

Benjamin Powell is Professor of Economics and Director of the Free Market Institute at Texas Tech University. He has published over 100 scholarly articles and books, including his edited volume of new research, The Economics of Immigration: Market-Based Approaches, Social Science, and Public Policy. New York: Oxford University Press. This Issue Brief is based on a public lecture that Professor Powell delivered at Western Carolina University on March 22, 2018. It draws on much of his prior published work on immigration. Some passages dealing with jobs and wages are drawn from his article, “An Economic Case for Immigration,” The Library of Economics and Liberty, Featured Article, June 7, 2010, http://www.econlib.org/library/Columns/y2010/Powellimmigration.html#.

_______

Footnotes

- Adam Smith, An Inquiry into the Nature and Causes of the Wealth of Nations, Glasgow Edition 1976, https://www.econlib.org/library/Smith/smWN.htm

- Julian Simon, 1983, The Ultimate Resource, Princeton: Princeton University Press.

- Michael Clemens, Claudio Montenegro, and Lant Pritchett, 2008, “The Place Premium: Wage Differences for Identical Workers across the US Border,” World Bank Policy Research Working Paper No. 4671.

- Michael Clemens, 2011, “Economics and Emigration: Trillion-Dollar Bills on the Sidewalk?” Journal of Economic Perspectives 25: 83–106.

- George Borjas, 1995, “The Economic Benefits of Immigration,” Journal of Economic Perspectives 9 (2): 3–22.

- See Michael Clemens and Jennifer Hunt, 2017, “The Labor Market Effects of Refugee Waves: Reconciling Conflicting Results,” NBER Working Paper No. 23433 and George Borjas, 2017, “The Wage Impact of the Marielitos: A Reappraisal,” ILR Review 70 (5): 1077–1110 for two examples showing the range of this debate.

- See Alex Nowrasteh, 2015, “The Fiscal Impact of Immigration,” in The Economics of Immigration, edited by B. Powell, New York: Oxford University Press for a good survey of these studies.

- See George J. Borjas, 2015, “Immigration and Globalization: A Review Essay,” Journal of Economic Literature 53 (4): 961–74 for an example of this conjecture.

- For examples of this new literature, see J. R. Clark, Robert Lawson, Alex Nowrasteh, Benjamin Powell, and Ryan Murphy, 2015, “Does Immigration Impact Institutions?”, Public Choice 163: 321–35; Benjamin Powell, J. R. Clark, and Alex Nowrasteh, 2017, “Does Mass Immigration Destroy Institutions? 1990s Israel as a Natural Experiment,” Journal of Economic Behavior & Organization 141: 83–95; Michael Clemens and Lant Pritchett, 2016, “The New Economics Case for Migration Restrictions: An Assessment,” IZA Discussion Paper 9730; Alexandre Padilla, and Nicolas Cachanosky, forthcoming, “The Grecian Horse: Does Immigration Lead to the Deterioration of American Institutions?” Public Choice; and Jamie Bologna Pavlik, Estefania Lujan Padilla, and Benjamin Powell, 2018, “Cultural Baggage: Do Immigrants Import Corruption?” https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3135446.

Further Readings

See the footnotes in this Issue Brief for references to academic journal articles related to points made in the text. In addition, see the following.

Powell, Benjamin. (ed.) 2015. The Economics of Immigration: Market-Based Approaches, Social Science, and Public Policy. New York: Oxford University Press.

This edited volume is written for general readers and provides broad summaries of different aspects of the economics literature on immigration.

Borjas, George. 2016. We Wanted Workers: Unraveling the Immigration Narrative. New York: Norton.

Borjas provides a more critical but still economically informed take on immigration.

Powell, Benjamin. 2018. “Raveling the Immigration Narrative.” Independent Review 22 (3). http://www.independent.org/publications/tir/article.asp?id=1258.

This is my response to the 2016 George Borjas book listed above.