What Do Film Incentives Mean for the North Carolina Economy?

John Charles Bradbury, Ph.D.

Kennesaw State University

Volume 2, Issue 1

Click the Button Below to Download a PDF Version of this Issue Brief

Since 2000, North Carolina has spent more than $400 million to subsidize movie production through grants and tax credits. Proponents of the subsidies argue that the expenses are offset by the economic development they generate; however, in recent years, several states have scaled back or ended their film-incentive programs because of concerns about cost and efficacy. This issue brief summarizes the existing research on the economic impact of film incentives as it relates to North Carolina. Studies consistently find little to no economic impact, and there is little evidence to indicate North Carolina’s incentives generate a positive impact for the state that justifies their expense.

In the late 1990s, several states began offering tax incentives to encourage movie-production companies to film in their respective states. The incentives were implemented with the intent to attract a new industry that would bring additional spending and jobs to the state economy. The hope was that film production would also stimulate economic activity in complementary industries—such as construction, transportation, hospitality, and tourism—and thus the economic effects would ripple through the state’s economy and foster economic growth.

Since 1997, forty-four states have offered film incentives for the purpose of stimulating local economic development. Though the incentives vary by state, they typically refund a percentage of in-state film-production expenditures through tax credits or grants. The subsidies lower production costs and thus make filming in the state more attractive. While these programs are expensive, supporters argue that film production generates economic activity that more than covers the cost of the subsidies.

A Brief History of North Carolina’s Film-Incentive Programs

North Carolina was an early adopter of film incentives. In 2000, it created the Film Industry Development Account to provide grants to production companies that filmed in the state. The initial law provided an annual grant of up to 15 percent of direct spending for movie productions, capping grants at $200,000 per production. The legislation also allowed production companies to use state property for free, and television and other video productions were also eligible for the grant.[1]Though the available subsidies were small by present standards, at the time no neighboring state offered any incentives, and North Carolina was one of only six states in the country offering such incentives.[2]

In 2005, North Carolina switched to a refundable tax-credit program, with credits equal to 15 percent of direct spending on film projects of $250,000 or more, and significantly increased the maximum subsidy to $7.5 million per production.[3]The refundable feature of the tax credit allowed film companies to recover costs beyond their tax liability directly from the state.[4]By this time, using incentives to lure filmmakers had become a popular policy initiative across the country— a majority of states would offer film incentives by 2006. Also in 2005, North Carolina’s southern neighbor Georgia began its aggressive pursuit of the film industry with an uncapped tax-credit program. After initially offering tax credits of 9 to 12 percent of expenditures, the state increased its credits to 20 to 30 percent in 2008. In 2010, in the midst of the growing arms race of incentives, North Carolina increased its tax credit to 25 percent of in-state spending and raised the allowable subsidy to $20 million per film.[5]

In 2014, the state scaled back its incentives by allowing its tax-credit program to sunset and adopting a smaller and budget-constrained grant-based incentive program. The state continued to offer grants of 25 percent of film-production spending, but it lowered the maximum per-film reimbursement to $5 million, limited subsidy eligibility to projects spending a minimum of $5 million, and allocated only $10 million per year to fund the grants. In 2015, the state increased grant funding to $30 million; it then stabilized program funding with $31 million in recurring funds going forward in 2017.[6]In 2018, the maximum funding per film increased to $9 million and the in-state expenditure requirement was lowered to $3 million.[7]

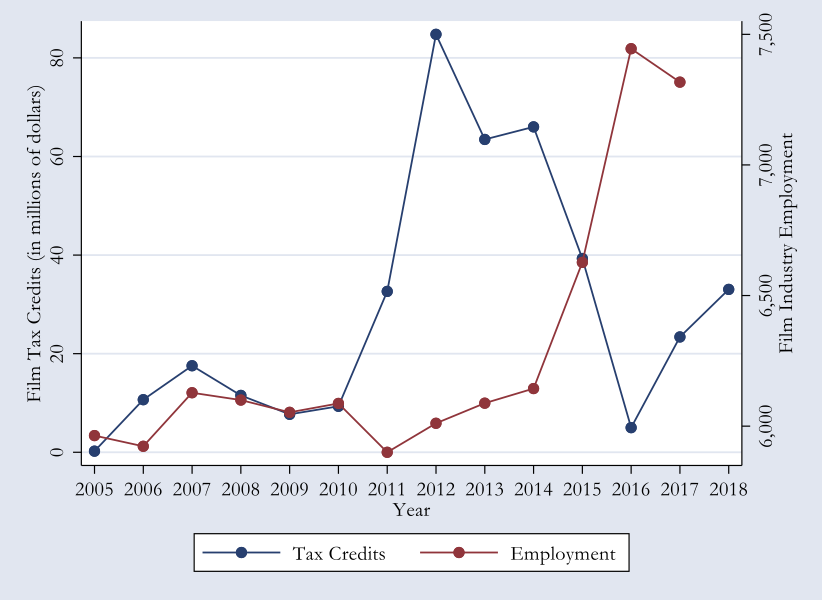

Table 1 reports by year the grants and credits approved in the state, using data from the Department of Revenue’s annual report on economic incentives. Since 2005, North Carolina has approved more than $400 million in subsidies for film production. The state’s most generous subsidies were offered from 2012 to 2014 under its tax-credit program.[8]Though subsidies declined with the moderation of incentives in 2014, in recent years funding has increased as the state has become more liberal with its grant requirements and limitations: lowering expenditure minimums, raising per-film subsidy caps, expanding the grant budget, and eliminating the grant program’s impending sunset date.[9]

Table 1. NC Tax Credits and Grants to Film Industry (2005–18)

| Year | Grant/Credit Payout |

| 2005 | $229,871 |

| 2006 | $10,668,976 |

| 2007 | $17,554,297 |

| 2008 | $11,538,071 |

| 2009 | $7,701,758 |

| 2010 | $9,331,955 |

| 2011 | $32,635,573 |

| 2012 | $84,779,742 |

| 2013 | $63,457,840 |

| 2014 | $66,011,257 |

| 2015 | $39,305,197 |

| 2016 | $5,000,000 |

| 2017 | $23,399,791 |

| 2018 | $33,041,025 |

| Total | $404,655,352 |

| Average | $28,903,954 |

| Source: North Carolina Department of Revenue, | |

| Economic Incentives Reports, various years | |

| https://www.ncdor.gov/news/reports-and-statistics/film-credits-and-grants | |

Studies of Film Incentives in Other States

The widespread use of film incentives across states has allowed researchers to study their economic impact. The earliest studies of the efficacy of film subsidies were conducted by state agencies and focused on the return on investment through taxes. The tax dollars going out (in grants) or not coming in (because of tax credits) were compared to new tax revenue from economic activity generated by the film industry. If the return on investment was positive because of the increased industry activity, that meant each dollar spent on film subsidies generated more than a dollar for the state government. However, studies tended to find a negative return on investments (less than one dollar) in film subsidies. Missouri estimated its return was between eleven and nineteen cents per dollar spent.[10]A report for Maryland estimated that a dollar of its film incentives generated a return of ten cents—six cents to the state and four cents to local governments—and recommended allowing the program to sunset.[11]Studies by state agencies in Connecticut, Louisiana, Michigan, Rhode Island, and Wisconsin also indicated their states’ programs were generating negative returns.[12]A recent comprehensive cost-benefit analysis of all state film-incentive programs by economists Mark Owens and Adam Rennhoff found the returns to be negative for every state, with the average return being twenty-seven cents per dollar of state expenditure. This analysis included North Carolina, for which the authors estimated that the return was twenty-two cents on the dollar.[13]

Researchers have also examined the effect of incentives on location, employment, industry agglomeration, and economic output. Because the incentives lower the cost of filming, production companies are expected to film in states with better incentives and thus hire more workers and generate more economic activity.

As for location, incentives do not appear to be a strong driver of where films are produced or promote a more permanent film industry. Economist Patrick Button found that while some types of film production increased with incentives, the incentives were not associated with the development of a significant film industry.[14]Similarly, while Owens and Rennhoff found that the incentives attracted some productions, they failed to find strong evidence that they created a more permanent movie industry.[15]

Nor does it appear that film incentives have a strong effect on film employment. Button found some employment effects, but described the estimates as “very small” and “weak.”[16]Accountant Charles Swenson found that incentives were effective at increasing film-sector employment in New York and California (states with already-large film sectors), but not in other states.[17]Political scientist Michael Thom found that incentives were not associated with film-industry employment, output, or concentration; although, industry workers may have experienced a small temporary wage boost.[18]Thom also looked specifically at California’s film-incentive program and found no impact on employment in the industry.[19]Economist Richard Adkisson similarly found no employment effects in the film industry. He concluded, “Ultimately, it seems that whatever states invested in this effort was largely for naught.”[20]

If film incentives do not have much impact on the film industry itself, it indicates that subsidizing filmmaking is likely an unproductive channel for growing state economies. However, it is possible that film incentives stimulate economic activity in related industries, which could translate into further spending to boost income and employment throughout the state’s economy. To investigate this possibility, I examined the performance of state economies with and without film subsidies, looking at the existence, type, and size of the subsidies offered. I found a few instances of potentially positive impacts of incentives on the film industry, but even in these instances the relationship was not particularly strong, and most estimates indicated no effect. Overall, film incentives were not associated with the size and growth of state economies.[21]

In summary, researchers do not find film incentives to be strongly correlated with film-industry activity, size, stability, or employment in states. Furthermore, film incentives do not appear to boost state economies. The findings are consistent across many studies using a variety of empirical methods, which indicates a strong academic consensus that film incentives are impotent as an economic -development tool.

North Carolina’s Economic Experience

Though the evidence from other states does not support the claim of strong economic impacts from film incentives, perhaps North Carolina has some unique characteristics that make it particularly suitable for movie production (e.g., geography, economy, infrastructure) and translate into economic growth. A few studies have focused directly on the state’s experience, and the findings are similar to those in other states.

In 2013, North Carolina General Assembly’s Fiscal Research Division analyzed the state’s film tax-credit program, which Pew Charitable Trusts described as a “rigorous assessment of the program’s economic impact.”[22]Using data from 2011, the Fiscal Research Division estimated that the tax credits likely attracted between 55 and 70 jobs and increased economic output by $7 million. Using the value of tax credits issued, that translates to a return of twenty-three cents on the dollar, similar to Owens and Rennhoff’s estimates reported above.[23]To assess the opportunity cost of funds used to subsidize film projects, the report estimated that using those funds to reduce business taxes across the board would have added between 290 and 350 new jobs and increased output by $45 million. Thus, by the state’s own analysis, subsidizing the film industry was a relatively poor use of resources.

The report also examined the effect of the film credits on film-industry employment in the state by comparing the credits claimed and industry employment by year. If film credits are a key driver of industry employment, then the two variables should be positively correlated. However, the results did “not point to a particularly strong connection.”[24]Figure 1 updates this comparison to run from 2005 to 2018 and confirms that tax credits and film-industry employment were not positively correlated during the longer timeframe.[25]While credits may motivate some filming in North Carolina, it appears that production companies are choosing to film in the state for other reasons as well. Thus, the subsidies went to production companies without generating many jobs.

In summary, studies of North Carolina’s film incentives have not demonstrated the strong positive returns claimed by their proponents. These findings are consistent with analyses of film incentives in other states by state agencies and academic researchers.

A Counterfactual Analysis

An obvious question to ask is “What would North Carolina’s economy look like without its film subsidies?” Economists have recently developed tools to answer such counterfactual questions. Using an empirical procedure known as the synthetic control method, we can compare the actual outcomes that follow policy implementation with what would likely have happened if the policies had never been adopted. The counterfactual comparison is constructed from states with similar characteristics that did not adopt the policy. Economist Patrick Button used this method to examine the impact of film incentives in Louisiana and New Mexico—two prominent early adopters of film incentives—and found some increased filming but no impact on film-industry employment and business establishments .[4]

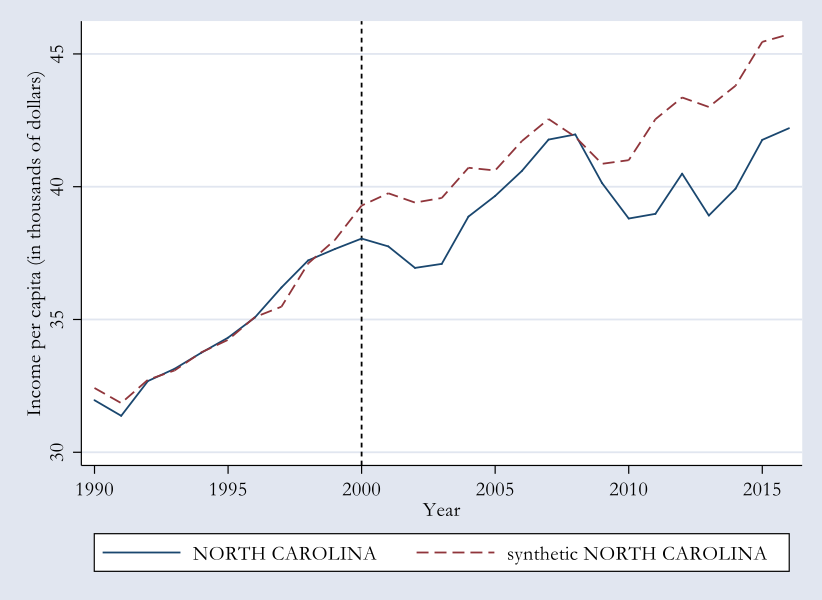

I employ the synthetic control method to examine how adopting film incentives affected North Carolina’s economy, as measured by income per capita. If film subsidies generate economic growth as claimed, then North Carolinians’ income should have increased after the state’s film-subsidy programs took effect. I use several relevant economic characteristics of similar states that lack film incentives to construct a “synthetic” North Carolina, which provides a counterfactual estimate of how the state economy might have performed absent its film incentives.[5]

Figure 2 maps the income per capita of North Carolina in reality in comparison to that in the counterfactual. From 1990 to 1999, prior to the state’s first film-grant program, incomes nearly overlap, indicating that the variables used to create the counterfactual estimate are appropriate. After 2000, the actual and synthetic economies diverge, with North Carolina’s actual performance falling below its synthetic counterpart. The comparison suggests that North Carolina’s economy was not improved by its film incentives and that it may be worse off. This finding should not be surprising given the consistent lack of efficacy found in other studies. Though this comparison is somewhat speculative, it is yet another example where film incentives are not associated with a positive economic impact.

[1]The MPAA is a film industry advocacy group that represents the five major Hollywood studios and Netfilx.

[2]Handfield (2014).

[3]McHugh and Boardman (2014).

[4]Button (in press).

[5]See the appendix for further details on this empirical method and estimates.

North Carolina has pursued the film industry with subsidies to foster economic growth. However, studies of the impact of film incentives on North Carolina and other states’ economies consistently find that film incentives are not associated with improved economic outcomes. Cost-benefit analyses estimate that North Carolina’s return on investment from its film subsidies ranges from twenty-two to sixty-one cents on the dollar, with most estimates closer to the lower end of that range. These North Carolina estimates are consistent with the estimates of negative returns in other states. Academic studies on film subsidies have found no positive impact on the film industry or on the overall economy, indicating strong consensus that film incentives are ineffective for generating economic development. In summary, North Carolina’s film incentives, which have cost the state over $400 million, do not appear to have delivered the promised economic boost. For this reason, policy makers may wish to reconsider the state’s commitment to the incentives.

Further Reading

Readers can dive into the papers in the References list below, although some of these can be technical and highly detailed. For more accessible further readings, consider two options. First, the non-partisan National Conference of State Legislators provides updates on state film incentive programs across the United States. Its periodic reports include descriptions of current programs and policy trends. Its latest report, “State Film Production Incentives and Programs,” (February 5, 2018) highlights the trend of states ending and scaling back their film incentive programs. Second, the Pew Charitable Trusts evaluated North Carolina’s tax incentives in 2017 and noted that the General Assembly’s Fiscal Research Division’s analysis of its film incentive program, which showed a poor return on investment, was a “rigorous” and “high-quality” assessment. See Fact Sheet, “North Carolina Tax Incentives Evaluation Ratings” (May 3, 2017).

References

Adkisson, R. V. 2013. “Policy Convergence, State Film-Production Incentives, and Employment: A Brief Case Study,” Journal of Economic Issues47, pp. 445-54. https://www.tandfonline.com/doi/abs/10.2753/JEI0021-3624460218.

Bradbury, J. C. 2019. “Do Movie Production Incentives Generate Economic Development?” Working paper. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3155407.

Button, P. In press. “Can Tax Incentives Create a Local Film Industry? Evidence from Louisiana and New Mexico,” Journal of Urban Affairs. https://www.tandfonline.com/doi/abs/10.1080/07352166.2018.1530570.

Button, P. 2019. “Do Tax Incentives Affect Business Location and Economic Development? Evidence from State Film Incentives,” Regional Science and Urban Economics 77, pp. 315-39. https://www.sciencedirect.com/science/article/pii/S0166046218300152.

Christopherson, S., and N. Rightor. 2010. “The Creative Economy as ‘Big Business’: Evaluating State Strategies to Lure Filmmakers,” Journal of Planning Education and Research29, pp. 336-52. https://journals.sagepub.com/doi/abs/10.1177/0739456X09354381.

Cox, J. B. 2009. “When N.C. Couldn’t Sweeten Deal, the Mouse Walked,” News & Observer, June 9, 2009.

Department of Legislative Services, Office of Policy Analysis. 2015. “Evaluation of the Maryland Film Production Activity Credit.” http://dls.maryland.gov/pubs/prod/TaxFiscalPlan/Evaluation-of-the-Maryland-Film-Production-Activity-Tax-Credit.pdf.

Handfield, R. 2014. “A Supply Chain Study of the Economic Impact of the North Carolina Motion Picture and Television Industry.” Report. https://wwwcache.wral.com/asset/news/state/nccapitol/2014/10/10/14064040/NC_Film_Supply_Chain_Study_3.31.14.PDF.

McHugh, P. 2013. “Film Tax Credits.” Fiscal Research Division, North Carolina General Assembly. Memo April 9 http://wwwcache.wral.com/asset/news/state/nccapitol/2013/08/16/12784762/201308161256.pdf.

McHugh, P., and B. Boardman. 2014. “Preliminary Review of Handfield Film Study.” Fiscal Research Division, North Carolina General Assembly. Memo April 3. https://wwwcache.wral.com/asset/news/state/nccapitol/2014/10/10/14064037/Review_of_Handfield_Film_Study_-_Rep_Catlin_1_.pdf.

Owens, M., and A. Rennhoff. In press. “Motion Picture Production Incentives and Filming Location Decisions: A Discrete Choice Approach,” Journal of Economic Geography.https://academic.oup.com/joeg/advance-article-abstract/doi/10.1093/jeg/lby054/5205905.

Oversight Division 2013. “Sunset Review: Film Production Tax Credit.” Report for Missouri General Assembly. http://www.moga.mo.gov/oversight/Sunset_Reviews/FilmProdTaxCred2013.pdf

Pew Charitable Trusts 2017. “How States Are Improving Tax Incentives for Jobs and Growth.” Report. May. https://www.pewtrusts.org/en/research-and-analysis/reports/2017/05/how-states-are-improving-tax-incentives-for-jobs-and-growth.

Swenson, C. W. 2017. “Preliminary Evidence on Film Production and State Incentives,” Economic Development Quarterly31, pp. 65-80. https://journals.sagepub.com/doi/full/10.1177/0891242416674807.

Thom, M. 2018a. “Lights, Camera, but No Action? Tax and Economic Development Lessons from State Motion Picture Incentive Programs,” American Review of Public Administration48, pp. 33-51. https://journals.sagepub.com/doi/abs/10.1177/0275074016651958.

Thom, M. 2018b. “Time to Yell ‘Cut?’ An Evaluation of the California Film and Production Tax Credit for the Motion Picture Industry,” California Journal of Politics and Policy10, pp. 1-20. https://escholarship.org/uc/item/3rf6v988.

Appendix

The per capita income for the synthetic North Carolina is estimated using the following characteristics: the state’s private capital stock, per capita employment, the share of total earnings from agriculture, the share of total earnings from the federal government, the film industry’s share of the state’s economy, and income per capita in 1990, 1994, and 1999. The six states used for comparison that have never had active film-incentive programs are Delaware, Idaho (it approved a program but never funded it), Nebraska, New Hampshire, North Dakota, and South Dakota. State weights for the characteristics were generated using the synthetic control method developed by Abadie and Gardeazabal (2003) and furthered by Abadie, Diamond, and Hainmueller (2010) and Abadie, Diamond, and Hainmueller (2015). The weights generated for each state to estimate the synthetic North Carolina are listed in table A.1. The actual and synthetic values estimated for each variable are listed in table A.2 for comparison.

Table A.1. State Weights for Synthetic North Carolina

| State | Unit Weight |

| Delaware | 0 |

| Idaho | 0.531 |

| Nebraska | 0.262 |

| New Hampshire | 0.208 |

| North Dakota | 0 |

| South Dakota | 0 |

Table A.2. Income Predictors for North Carolina

| Variables | Real | Synthetic |

| ln (Net Private Capital Stock Per Capita (in Millions)) | 0.0400 | 0.0398 |

| Employment Per Capita | 0.5891 | 0.5903 |

| Federal Government Earning (%) | 0.0176 | 0.0224 |

| Agriculture (%) | 0.0167 | 0.0361 |

| Film Industry (%) | 0.0008 | 0.0008 |

| Income Per Capita (1990) | 31.9610 | 32.4214 |

| Income Per Capita (1994) | 33.7494 | 33.7643 |

| Income Per Capita (1999) | 37.6539 | 37.9971 |

Appendix References

Abadie, A., A. Diamond, and J. Hainmueller. 2015. “Comparative Politics and the Synthetic Control Method,” American Journal of Political Science59, pp. 495–510. https://onlinelibrary.wiley.com/doi/abs/10.1111/ajps.12116.

Abadie, A., A. Diamond, and J. Hainmueller. 2010. “Synthetic Control Methods for Comparative Case Studies: Estimating the Effect of California’s Tobacco Control Program,” Journal of the American Statistical Association105, pp. 493–505. https://www.tandfonline.com/doi/abs/10.1198/jasa.2009.ap08746.

Abadie, A., and J. Gardeazabal. 2003. “The Economic Costs of Conflict: A Case Study of the Basque Country,” American Economic Review93, pp. 113-32. https://www.aeaweb.org/articles?id=10.1257/000282803321455188